Menu

The Fund in partnership with Visa and Centenary Bank unveiled a three-in-one social security Smart Card which embeds NSSF functionality, bank functionality and a loyalty programme, the first of its kind in East Africa. The card forms a critical component of the Fund’s digitalisation strategy which is geared at leveraging new technology to improve efficiencies, customer experience, and ultimately make saving a way of life for Ugandans. This innovation will go a long way in driving financial inclusion and promoting service delivery to all our members.

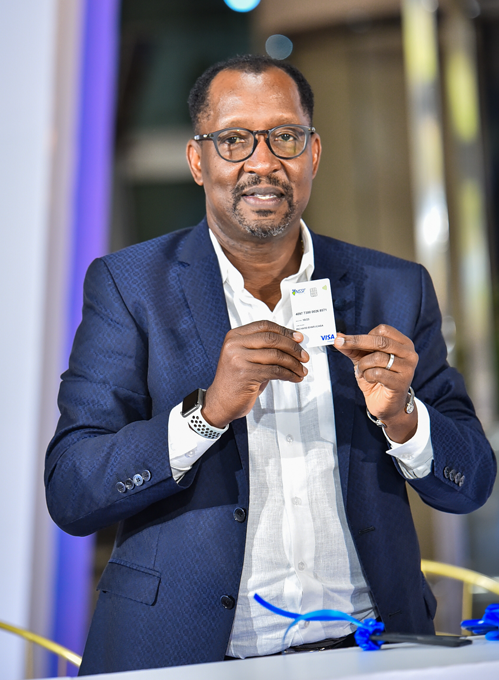

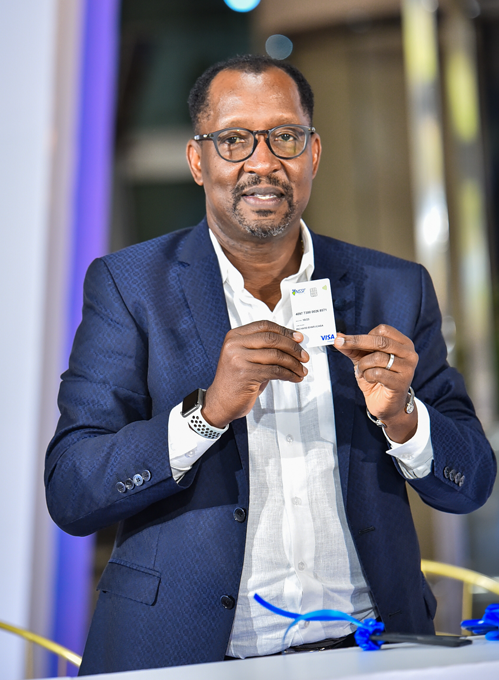

Richard Byarugaba displaying his Smart Card at the Staff Internal Launch

Using the Smart Card, the Fund’s members can directly withdraw their NSSF savings upon qualification, deposit and withdraw money from their bank accounts, pay bills and make transactions online, at ATMs and Point of Sale terminals. In addition, they will access exclusive deals from selected merchants. Under this partnership, Centenary Bank will provide NSSF members with direct banking services, while Visa will facilitate financial transactions at any of their locations worldwide.

The Smart Card complements our digital claims process, providing easy and fast validation for qualifying members to withdraw their savings promptly. This supports our strategy to improve the turnaround time for benefits processing to one day, by 2025.

The Fund in partnership with Visa and Centenary Bank unveiled a three-in-one social security Smart Card which embeds NSSF functionality, bank functionality and a loyalty programme, the first of its kind in East Africa. The card forms a critical component of the Fund’s digitalisation strategy which is geared at leveraging new technology to improve efficiencies, customer experience, and ultimately make saving a way of life for Ugandans. This innovation will go a long way in driving financial inclusion and promoting service delivery to all our members.

Richard Byarugaba displaying his Smart Card at the Staff Internal Launch

Using the Smart Card, the Fund’s members can directly withdraw their NSSF savings upon qualification, deposit and withdraw money from their bank accounts, pay bills and make transactions online, at ATMs and Point of Sale terminals. In addition, they will access exclusive deals from selected merchants. Under this partnership, Centenary Bank will provide NSSF members with direct banking services, while Visa will facilitate financial transactions at any of their locations worldwide.

The Smart Card complements our digital claims process, providing easy and fast validation for qualifying members to withdraw their savings promptly. This supports our strategy to improve the turnaround time for benefits processing to one day, by 2025.

Joseph Balikuddembe, the Executive Director of Centenary Bank said – “As a bank on its journey to becoming a SMART Bank by 2026, we are honoured to be part of this game-changing innovation in the pension industry. We do believe it will enhance customer convenience and NSSF members will enjoy banking services across our 81 branches, Point of Sale terminals, 192 ATMs and 5,200 agents. The debit and pre-paid cards come with a SMART life account that targets existing and new NSSF members, offering a free card and free charge account coupled with great card discounts from our partner merchants.”

Centenary Bank Executive Director, Joseph Balikuddembe

Thembeka Ngugi, Visa Senior Director for sub-Saharan Africa said – “We are delighted to welcome NSSF members to the Visa network where they can enjoy secure and convenient financial services. Embracing digital payments and a potentially cashless society is where the future lies. Visa is investing more than ever in our global assets, infrastructure and digital capabilities to reshape the future of commerce. Digital payments, such as those enabled by Visa, are the first step to financial inclusion, which is why we are investing in new ways to reach everyone by offering benefits that will transform their payments experience.”

Visa Card Senior Director for Sub-Saharan Africa, Thembeki Ngugi

Bank of Uganda Deputy Governor, Michael Atingi-Ego, applauded NSSF, Centenary Bank and Visa for this innovation, saying this Smart Card is in line with the Central Bank’s financial inclusion agenda, which promotes access and usage of financial services. He assures members of the safety of their funds while transacting with the banks.

Bank of Uganda Deputy Governor, Michael Atingi-Ego

Joseph Balikuddembe, the Executive Director of Centenary Bank said – “As a bank on its journey to becoming a SMART Bank by 2026, we are honoured to be part of this game-changing innovation in the pension industry. We do believe it will enhance customer convenience and NSSF members will enjoy banking services across our 81 branches, Point of Sale terminals, 192 ATMs and 5,200 agents. The debit and pre-paid cards come with a SMART life account that targets existing and new NSSF members, offering a free card and free charge account coupled with great card discounts from our partner merchants.”

Centenary Bank Executive Director, Joseph Balikuddembe

Thembeka Ngugi, Visa Senior Director for sub-Saharan Africa said – “We are delighted to welcome NSSF members to the Visa network where they can enjoy secure and convenient financial services. Embracing digital payments and a potentially cashless society is where the future lies. Visa is investing more than ever in our global assets, infrastructure and digital capabilities to reshape the future of commerce. Digital payments, such as those enabled by Visa, are the first step to financial inclusion, which is why we are investing in new ways to reach everyone by offering benefits that will transform their payments experience.”

Visa Card Senior Director for Sub-Saharan Africa, Thembeki Ngugi

Bank of Uganda Deputy Governor, Michael Atingi-Ego, applauded NSSF, Centenary Bank and Visa for this innovation, saying this Smart Card is in line with the Central Bank’s financial inclusion agenda, which promotes access and usage of financial services. He assures members of the safety of their funds while transacting with the banks.

Bank of Uganda Deputy Governor, Michael Atingi-Ego